Why Your Insurance Pays Less for Generic Drugs

When you pick up a prescription, you might see two options: the name you recognize from TV ads, or a plain-looking pill with a chemical-sounding name. The difference isn’t just in the packaging-it’s in how your insurance covers them. Generic drugs are legally required to be identical to brand-name drugs in active ingredients, strength, dosage, and how they work in your body. But your copay? It’s often 80% lower. That’s not a mistake. It’s policy.

How Formularies Decide What You Pay

Insurance companies organize drugs into tiers. Think of it like a pricing ladder. Generics sit at the bottom-Tier 1-with copays as low as $5 to $15 for a 30-day supply. Brand-name drugs? They’re usually on Tier 2 or 3, where you pay $40 to $100 or more. If a generic exists, your plan expects you to take it. If you choose the brand anyway, you don’t just pay the higher copay-you also pay the full price difference between the brand and the generic. That means a $120 brand-name drug with a $5 generic could cost you $115 out of pocket, even if your copay is only $40.

Why Pharmacists Are Pushing Generics

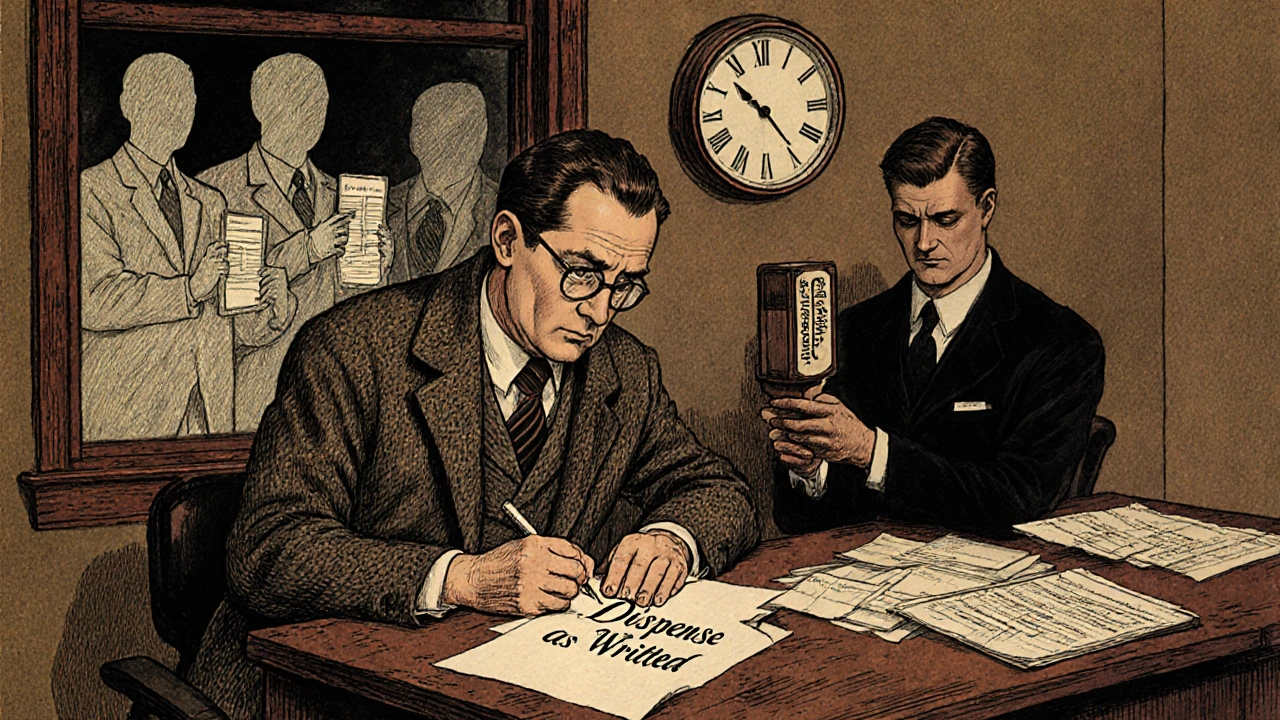

In every U.S. state, pharmacists can swap a brand-name drug for a generic unless the doctor writes “dispense as written” on the prescription. This isn’t optional-it’s standard practice. Insurance companies built this into their contracts with pharmacies. The goal? Cut costs. In 2022, 90% of all prescriptions filled in the U.S. were generics. That saved the system $370 billion that year alone. For Medicare Part D, the number is even higher: 91% of prescriptions were generics. The system is designed to push you toward the cheaper option, and it works.

When You Can Get the Brand Name Anyway

Just because a generic exists doesn’t mean you’re stuck with it. If your doctor believes the brand is medically necessary, they can override the substitution. This happens most often with drugs like levothyroxine, warfarin, or phenytoin-medications where tiny differences in how the body absorbs them can matter. Twenty-seven states have special rules for these “narrow therapeutic index” drugs, allowing brand coverage without extra paperwork. In 42 states, doctors just need to write a note explaining why the generic won’t work for you. But here’s the catch: getting that note approved can take days. The average prior authorization for a brand-name drug when a generic is available takes 3.2 business days. And 41% of those requests need a follow-up call from the doctor’s office.

What Happens When Generics Don’t Work for You

There’s a real debate here. The FDA says generics are just as safe and effective. And for most people, they are. But not everyone agrees. A 2022 study in JAMA Neurology found that switching from brand to generic anti-seizure meds led to a 12.3% increase in seizures in some patients. On patient forums like Drugs.com, threads with thousands of comments tell stories of people who switched to a generic version of Wellbutrin XL, Concerta, or Lamictal and suddenly felt worse-headaches, mood swings, even seizures. These aren’t rare cases. Sixty-eight percent of physicians report patients telling them they experienced side effects after switching to a generic-even though the active ingredient is the same. The problem? Inactive ingredients. Fillers, dyes, coatings. These aren’t regulated as strictly as the active drug, and they can affect how the medicine is absorbed. For some, that’s enough to break the treatment.

Medicare, Medicaid, and Commercial Plans-Big Differences

Not all insurance is the same. Medicare Part D requires pharmacists to substitute generics unless medically unnecessary. But once you hit the “donut hole,” you pay 25% of the cost for both brand and generic drugs. Medicaid pays the lowest price available for generics-87% less than brand-name drugs-thanks to federal “best price” rules. Commercial insurers? They use step therapy. For 35.6% of specialty drugs, you must try the generic first. Only after two or three failed attempts can you get the brand. That can mean waiting 6 to 8 weeks just to get the right medication. And if you’re on a high-deductible plan, you might pay the full cash price for the brand before your insurance kicks in.

What’s Changing in 2025

The FDA is updating how generics are labeled, starting in 2025. New labels will clearly show if a generic is “therapeutically equivalent” to the brand. That’s important because not all generics are created equal-especially for complex drugs like inhalers or injectables. The Centers for Medicare & Medicaid Services (CMS) is also stepping in. Starting in 2024, prior authorizations for brand-name drugs when a generic is available must be decided within 72 hours. Right now, approval times range from same-day to two weeks. That inconsistency costs patients time-and sometimes health.

How to Navigate the System

- If your doctor prescribes a brand-name drug, ask if a generic is available. If yes, ask if it’s covered on Tier 1.

- If you switch to a generic and feel worse, tell your doctor immediately. Don’t wait. Document your symptoms.

- If your claim is denied, ask for a formulary exception. Most plans have a process-you just need to request it.

- Check your plan’s formulary online. Every insurer publishes it. Look up your drug and see what tier it’s on.

- For Medicare beneficiaries: Use the Plan Finder tool. It shows which plans cover your exact drug at the lowest cost.

- Don’t assume generics are always cheaper. Some brand-name drugs have copay cards that reduce your cost to $0. But these don’t work with Medicare or Medicaid.

Why This Matters More Than You Think

Insurance policies aren’t just about money-they’re about access. A 2022 Kaiser Family Foundation survey found that 19% of people skipped filling a prescription because they didn’t understand why the brand cost so much more. Another 34% were confused about when they could get the brand. That confusion leads to worse health outcomes. And for people managing chronic conditions-diabetes, epilepsy, depression-getting the right drug on time isn’t a luxury. It’s life or death. The system is built to save money. But when patients fall through the cracks because of unclear rules or slow approvals, the real cost isn’t dollars. It’s health.

What You Can Do Today

Know your plan. Know your drug. Know your rights. If you’re on a generic and it’s not working, speak up. If your doctor says you need the brand, make sure they document it properly. And if your pharmacy tries to swap your medication without telling you-ask why. You have the right to know what you’re getting. And you have the right to ask for the one that works for you.

Are generic drugs really the same as brand-name drugs?

Yes, by law. The FDA requires generic drugs to have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They must also meet the same standards for safety, purity, and effectiveness. The only differences are in inactive ingredients-like fillers and dyes-which can affect how some people absorb the drug, but not the drug’s overall effect.

Why do insurance companies prefer generics?

Generics cost 80% to 85% less than brand-name drugs because they don’t require expensive research, clinical trials, or marketing. Insurance companies save billions by pushing generics. In 2022, generics made up 90% of all prescriptions filled in the U.S., saving the system $370 billion that year alone.

Can I be forced to take a generic drug?

Yes, unless your doctor writes “dispense as written” or “do not substitute” on your prescription. Pharmacists are legally allowed to switch to a generic in all 50 states. But if you’ve had a bad reaction to a generic before, your doctor can request a medical exception.

What if the generic doesn’t work for me?

If you notice side effects or reduced effectiveness after switching to a generic, tell your doctor right away. For some drugs-like thyroid meds, seizure treatments, or blood thinners-small differences in absorption matter. Your doctor can file a prior authorization request for the brand-name version. Many plans require you to try two or three generics first, so document your experience carefully.

Do Medicare and Medicaid cover generics differently?

Yes. Medicare Part D requires pharmacists to substitute generics unless medically necessary, and 91% of its prescriptions are generics. Medicaid pays the lowest available price for generics-87% less than brand-name drugs-because of federal “best price” rules. But Medicare beneficiaries can’t use manufacturer copay cards, which are banned for federal programs.

How long does it take to get approval for a brand-name drug?

The average time for a prior authorization for a brand-name drug when a generic is available is 3.2 business days. But approval times vary widely-from same-day to 14 days-depending on your insurer. If your doctor needs to call or resubmit paperwork, it can take longer. Some plans now require step therapy, meaning you must try and fail on two or three generics before getting approval.

Are there drugs where generics aren’t allowed?

Not banned, but restricted. For drugs with a narrow therapeutic index-like warfarin, levothyroxine, and phenytoin-27 states have special rules allowing easier access to brand-name versions because small differences in absorption can cause serious side effects. Insurance plans often require less paperwork for these.

Can I use a brand-name copay card with my insurance?

Only if you’re on commercial insurance. Manufacturer copay cards can reduce your out-of-pocket cost for brand-name drugs to $0-$10. But federal law prohibits these cards from being used with Medicare, Medicaid, or other government programs. If you’re on Medicare, you’ll need to rely on plan formularies or financial assistance programs.

What’s the difference between a generic and an authorized generic?

An authorized generic is made by the original brand-name manufacturer but sold under a generic label. It’s identical to the brand in every way-including inactive ingredients. These are often covered more favorably by insurance than third-party generics because they’re seen as more reliable. About 46% of all generic prescriptions in 2023 were authorized generics.

Will insurance cover new drugs if there’s no generic yet?

Yes, but it depends. New drugs without generics are usually placed on the highest tier and often require prior authorization. Some insurers may delay coverage until after the patent expires and generics become available. In 2022, 53% of new FDA-approved drugs were specialty medications with no generic alternatives, so insurers are starting to adjust policies for these complex drugs.

Denny Sucipto

November 18, 2025 AT 06:20Been on a generic for my antidepressant for six months now. At first I thought I was just tired, but then I started zoning out during meetings, crying for no reason, and my hands shook like I had caffeine overdose. Switched back to the brand-boom, normal again. Doctors act like it’s all in our heads, but if your body’s screaming, listen to it. Not every pill is interchangeable, no matter what the FDA says.

Kristina Williams

November 19, 2025 AT 14:27They’re hiding something. Generics are made in China and India. The same factories that make fake phones and toxic toys. You think they care if your thyroid meds dissolve in your stomach or just sit there like a rock? The FDA is owned by Big Pharma. They want you on generics so they can sell you the brand later when you’re desperate. Wake up.

Christine Eslinger

November 20, 2025 AT 05:25Hey, I get it-switching generics can be terrifying, especially if you’ve got a chronic condition. But here’s the thing: for most people, it works fine. The real issue is that doctors don’t always explain what’s happening when you switch. If you feel off, document it. Take notes on sleep, mood, energy. Bring it to your doc with data, not just ‘I feel weird.’ And if your pharmacy swaps your med without telling you? That’s not okay. Ask for the original. You have rights.

Also, authorized generics? Those are the real MVPs. Same factory, same ingredients, just cheaper. If your plan covers it, go for that first. It’s the sweet spot between trust and savings.

Holly Powell

November 20, 2025 AT 10:54The systemic inefficiency here is staggering. The pharmacoeconomic incentives are misaligned at every layer-formulary design, prior authorization workflows, and therapeutic substitution protocols. The FDA’s ‘therapeutic equivalence’ designation is a statistical construct, not a biological guarantee. For drugs with nonlinear pharmacokinetics-like warfarin or phenytoin-the bioequivalence threshold of 80-125% AUC is laughably permissive. You’re essentially gambling with neurochemical stability.

And don’t get me started on step therapy. It’s not cost containment-it’s clinical negligence disguised as policy. The lag time between clinical deterioration and approval is the hidden mortality cost.

Emanuel Jalba

November 20, 2025 AT 23:53MY DOG GOT THE GENERIC FOR HIS SEIZURE MEDS AND HE HAD A SEIZURE IN THE MIDDLE OF THE LIVING ROOM 😭 I WAS CRYING AND THE PHARMACIST SAID ‘IT’S THE SAME CHEMICAL’ 🤬 I’M NOT A LAB RAT. I WANT THE BRAND. I PAY MY PREMIUMS. I DESERVE BETTER. #GENERICSWEREABADIDEA

Heidi R

November 21, 2025 AT 07:57You’re all overreacting. If you can’t tell the difference between a $5 pill and a $100 pill, maybe you shouldn’t be taking meds at all.

Louie Amour

November 22, 2025 AT 05:12Oh wow, so now we’re playing victim because your insurance saved you $95? Let me guess-you also think the government should pay for your organic kale smoothies and your 8-hour sleep schedule. Wake up. The system works. If you can’t handle a generic, you’re not sick-you’re entitled.

And don’t even get me started on people who say ‘I feel worse.’ You feel worse because you’re addicted to the branding. You think the color of the pill changes the chemistry. Newsflash: it doesn’t. Your brain is the problem, not the pill.

Brenda Kuter

November 23, 2025 AT 18:30THEY’RE DOING THIS ON PURPOSE. I KNOW IT. The drug companies paid off the FDA. They’re replacing the good pills with cheap ones so you get addicted to the brand and then they jack up the price. I read a whistleblower report once-there’s a whole underground network. My cousin’s neighbor’s cousin works at a lab in China and said they mix in chalk and sugar to make the generics last longer. I’m not crazy. I’ve seen the receipts.

Shaun Barratt

November 24, 2025 AT 23:44While I appreciate the depth of this analysis, I must note a minor typographical inconsistency in the section regarding Medicare Part D: ‘91% of prescriptions were generics’ should be followed by a semicolon before the subsequent clause regarding best price rules. Additionally, the phrase ‘dispense as written’ is correctly italicized, but the term ‘prior authorization’ appears inconsistently capitalized throughout the text. These are minor, yet professionally relevant, concerns.

Iska Ede

November 25, 2025 AT 10:33So let me get this straight: you’re mad because you saved $100 on your meds… but now you’re mad because you actually had to take the cheaper version? Congrats. You’re now a proud member of the ‘I paid for premium, so I deserve premium’ club. Next you’ll be mad your coffee was brewed with tap water instead of glacier melt.

Gabriella Jayne Bosticco

November 26, 2025 AT 15:27My mum’s on levothyroxine and switched to a generic last year. She felt fine-no issues. But she’s also the type who doesn’t complain unless something’s broken. I told her to keep a journal. She did. No changes in pulse, weight, or energy. But I get it-some people are more sensitive. It’s not about being lazy or entitled. It’s about biology being weird. If your doctor says brand is better, fight for it. No shame in that.

Sarah Frey

November 27, 2025 AT 04:10It’s worth noting that the FDA’s Therapeutic Equivalence Evaluation (Orange Book) clearly designates generics with an ‘AB’ rating as substitutable. However, for drugs with narrow therapeutic indices, the ‘AB’ designation does not guarantee identical clinical outcomes across all patient populations. This is why clinical judgment, patient history, and pharmacogenomic factors must inform substitution decisions-not just formulary tiers. Insurance policies must evolve to reflect this nuance.

Katelyn Sykes

November 28, 2025 AT 22:34Just got my generic Wellbutrin and my brain felt like it was wrapped in cotton. I called my doctor same day. He said ‘try it for two weeks’ I said ‘nope’ and asked for the brand. He wrote the note. Insurance denied it. I appealed. Took 11 days. Got approved. Back on brand. Now I’m back to normal. If you feel off after switching-speak up. Don’t wait. Your mental health isn’t a cost center.